Exploring Tony’s “Open” Chain | #PodSaveChocolate Ep 124

Episode 124 of #PodSaveChocolate is an exploration of Tony’s Open Chain, searching for answers to, among other questions, “How ‘Open’ is Open?”

When and Where to Watch

Links below to watch LIVE and to view the archived episode.

Click on this (shareable) link to watch on YouTube. Please subscribe (free!) to the @PodSaveChocolate YouTube channel, like this video, comment, and share this episode to help grow the #PSC community.

Watch and comment LIVE or view the archived episode on LinkedIn. Join my network on LinkedIn to receive notifications and to refer business to each other.

Watch and comment LIVE or view the archived episode on TheChocolateLife page on Facebook (for 30 days, then watch the archive on YouTube).

Follow TheChocolateLife on Facebook to receive notifications and catch up on other content.

Episode 124 Overview

Why this topic? In a recent episode of PodSaveChocolate I took a look at the 2025 Chocolate Scorecard. I also spent some tine looking at Tony’s 2o23-2024 annual “fair” report (“AFR”) because Tony’s came out on top in the Scorecard.

My examination of Tony’s 2023-2024 AFR lead me to believe Tony’s team made a mistake on a key reporting page – severely overstating how much they were paying for cocoa. I wrote about that on LinkedIn, and a Tony’s rep said that it was an “editing mistake.”

This post has been viewed nearly 110,000 times!

I don’t know how many people looked at the report in the more than three months between when it was published and when I found the error. But it look like I was the first person to see the inconsistency, comprehend the logical consequences, and call it to people’s attention.

Tony’s has updated the AFR to address the issue but did not indicate that the page had been edited – which is what I predicted they would do.

Reverse Mission Creep?

Misson Creep is a term that refers to the scope and goals of a mission increasing over time. Reverse Misson Creep refers to when the scope and goals of a mission decrease over time.

Does Tony’s mission exhibit symptoms of Reverse Mission Creep? In Tony’s 2012-2013 AFR the company wrote, on page 4:

“Tony’s Chocolonely was founded in an effort to attract attention to slavery in chocololate. ... Our vision is 100% slavery-free chocolate! This means not just our chocolate, no, all chocolate worldwide. Only then have we achieved our goal.”

I do want to acknowledge that Tony’s, perhaps more than any other brand, has attracted the attention of millions to the challenges of illegal labor practices, including slavery in cocoa supply chains.

BUT, in the 2o23-2024 AFR their vision has been rephrased:

“ ... if we act together as an industry, we really can end exploitation in the cocoa sector.”

What does this rephrasing mean? Is it an expansion of the mission or a contraction?

Tony’s Open Chain

So, what do know about Tony”s Open Chain? How Open is it, really?

Here is a case where using the word exploitation makes sense – it’s not just the farmers who can be exploited.

What can be learn about the inner workings of Tony’s Open Chain from reading the most recent annual report? Including:

1️⃣ What technologies do they use?

2️⃣ How much cocoa does each of the Open Chain partners purchase?

3️⃣ What price do they actually pay?

4️⃣ Who monitors/certifies/audits their work?

This episode of PodSaveChocolate explores that question: How Open is Tony’s Open Chain?

More links and resources

The LIRP – Damning with very faint praise

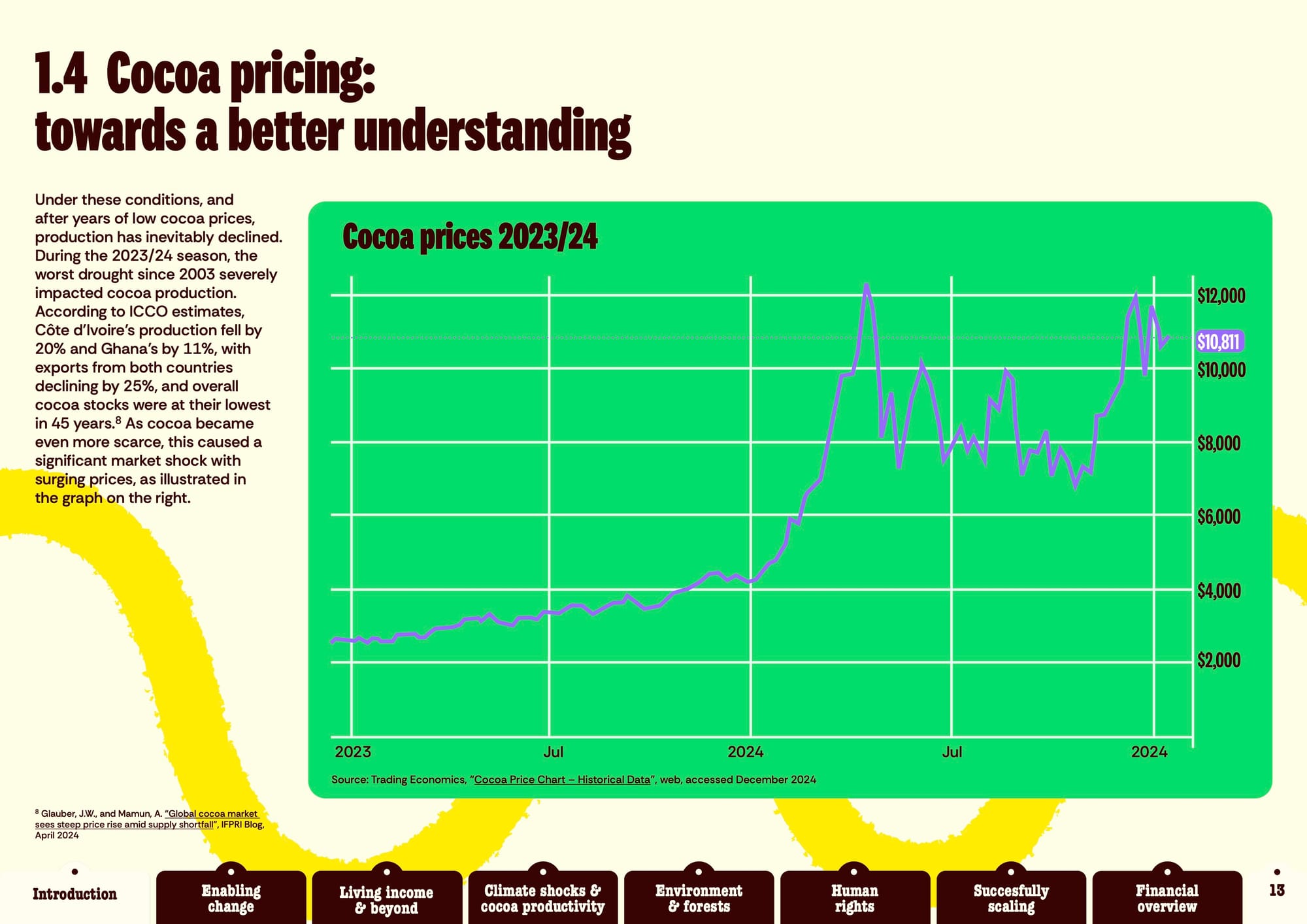

International Cocoa Organization (ICO) daily price (average of the first three trading positions on the New York and London terminal markets), the monthly prices in $USD/MT were:

• October 2023: $3,630

• November 2023: $4,028

• December 2023: $4,209

• January 2024: $4,398

• February 2024: $5,556

• March 2024: $7,089

• April 2024: $9,740

• May 2024: $7,538

• June 2024: $8,272

• July 2024: $7,089

• August 2024: $6,878

• September 2024: $6,524

Calculating the average of these monthly prices for the period of October 2023 to September 2024 gives an approximate average price of $6,245.92/MT. Why is anyone applauding Tony’s and their partners paying an average of one-third of the market average, even if it meets the

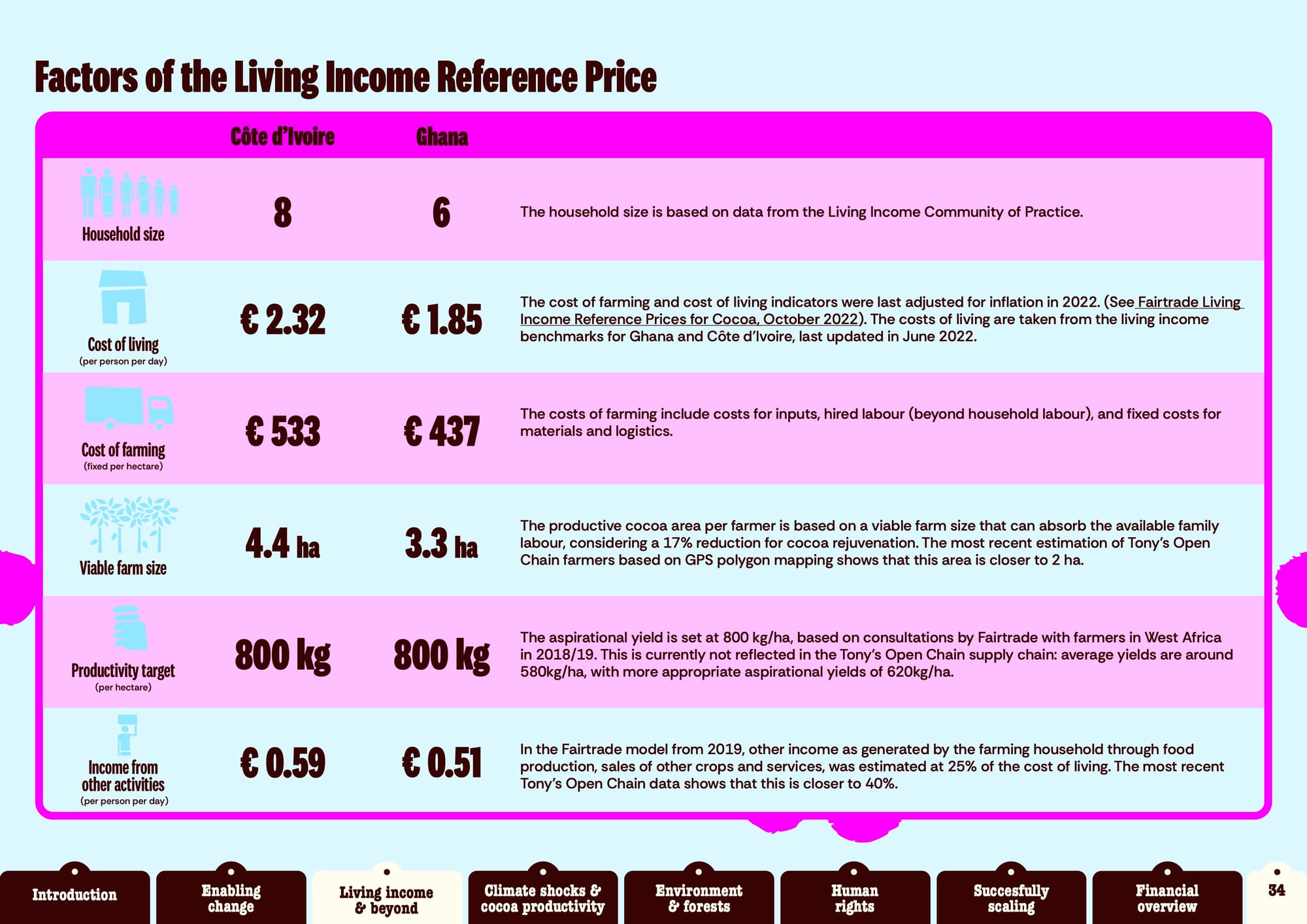

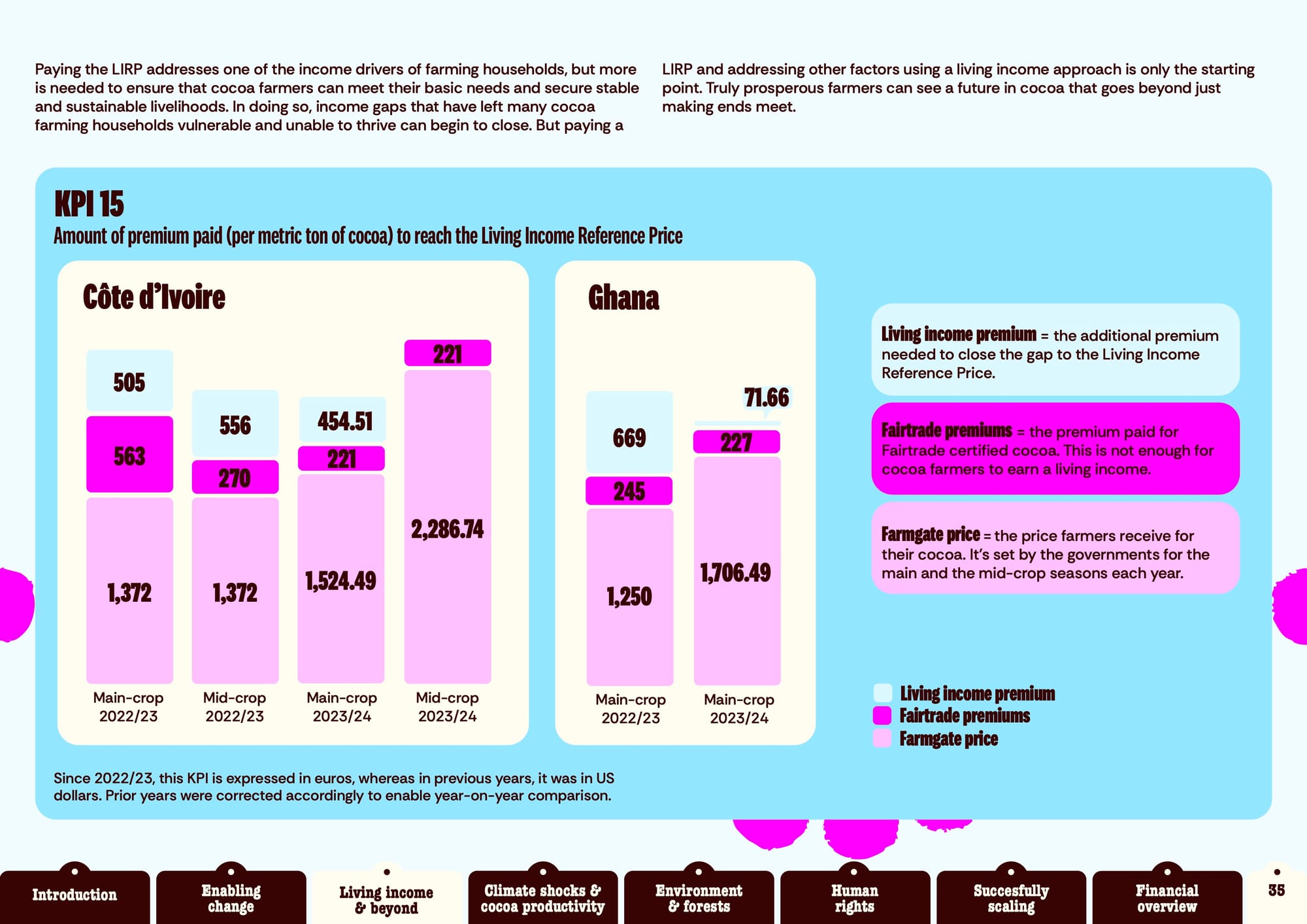

LIRP much? See p 167. Tony’s and its Mission Allies are paying in the low-€2000s/MT when the average market price during the period was over $6,200/MT. That low-€2000s includes the hundreds of €uros in “premiums” they paid.

Pages 145, 166-167.

There are “Lies, damn lies, and statistics.” (Attributed to Mark Twain, who does a H/T to Benjamin Disraeli. Wikipedia.)

It cost €4,685,202 to source 17,690MT of cocoa for Tony’s Open Chain in 2023-2024 (at a net loss of €580,000). That’s nearly €265/MT. Tony’s does not report how many FT employees are in Africa, but one estimate places it at 17 people. Double that number and employees are being paid over €30,000/year each, on average. This is a naive figure because it many include office rental, the cost of vehicles, fuel, and other operating costs and personnel subsidies. Any way you cut it, it’s way more than farmers are paid.

P 206

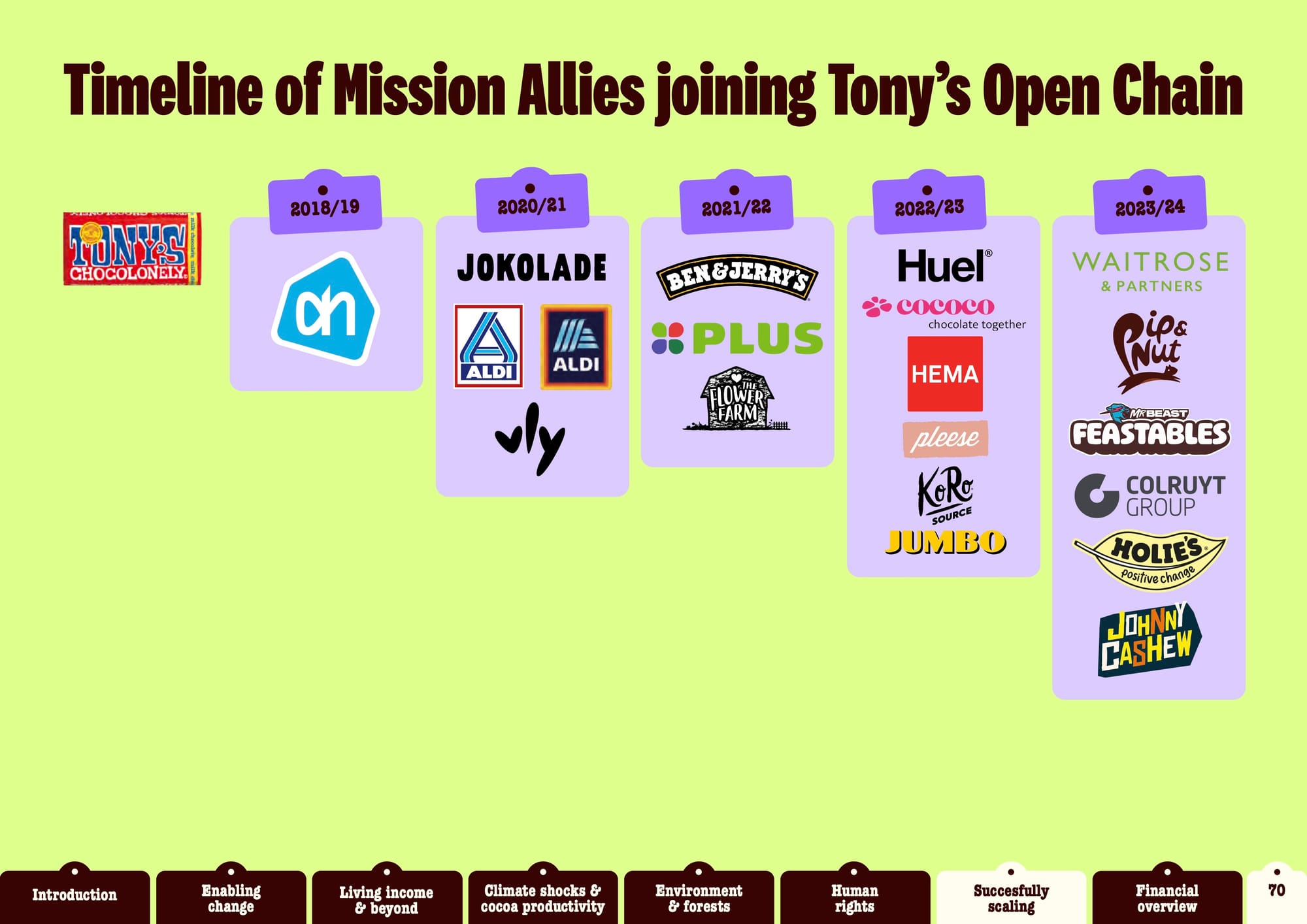

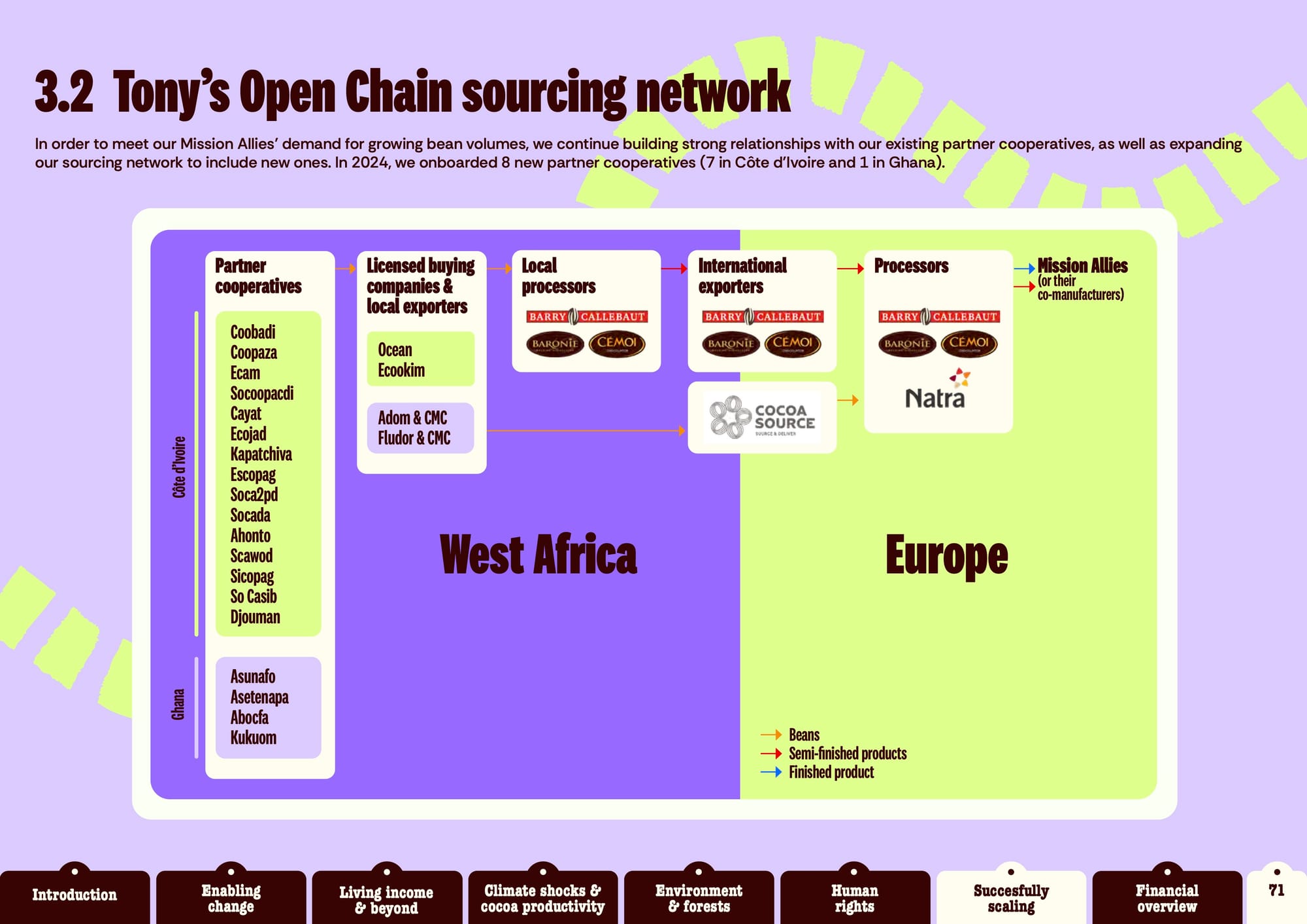

Tony’s Open Chain Mission Allies & Sourcing Network

Most of Tony’s Open Chain Mission Allies are retailers, not manufacturers. Pages 202-203.

There is no obvious differentiation between the amount of cocoa Tony’s consumes in relation to its mission allies (which it counts itself as). The goal of 30,000 MT for the 2024/2025 is the total for all Open Chain Allies. Tony’s chocolate business appears to be conflating Open Chain figures with its core business.

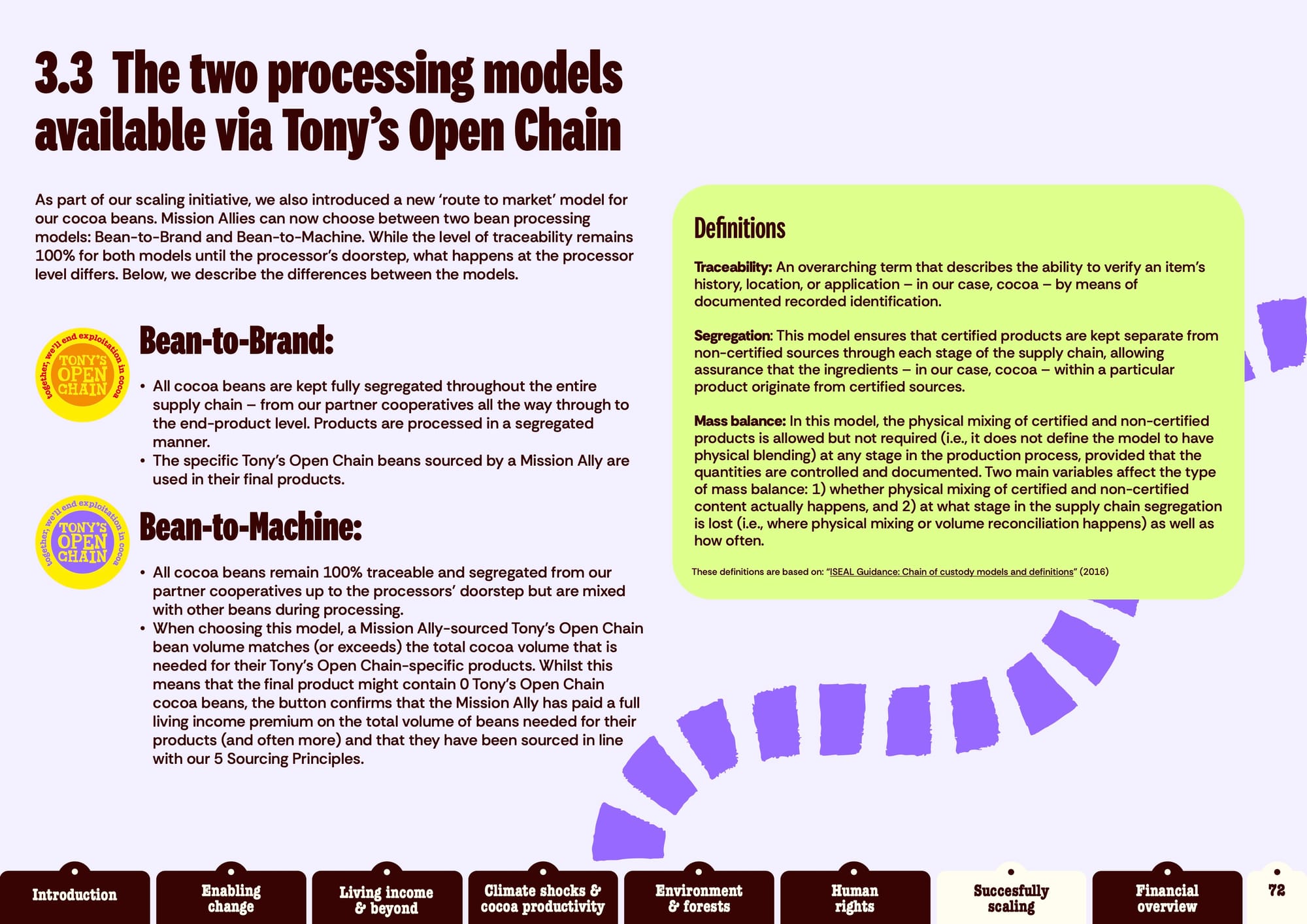

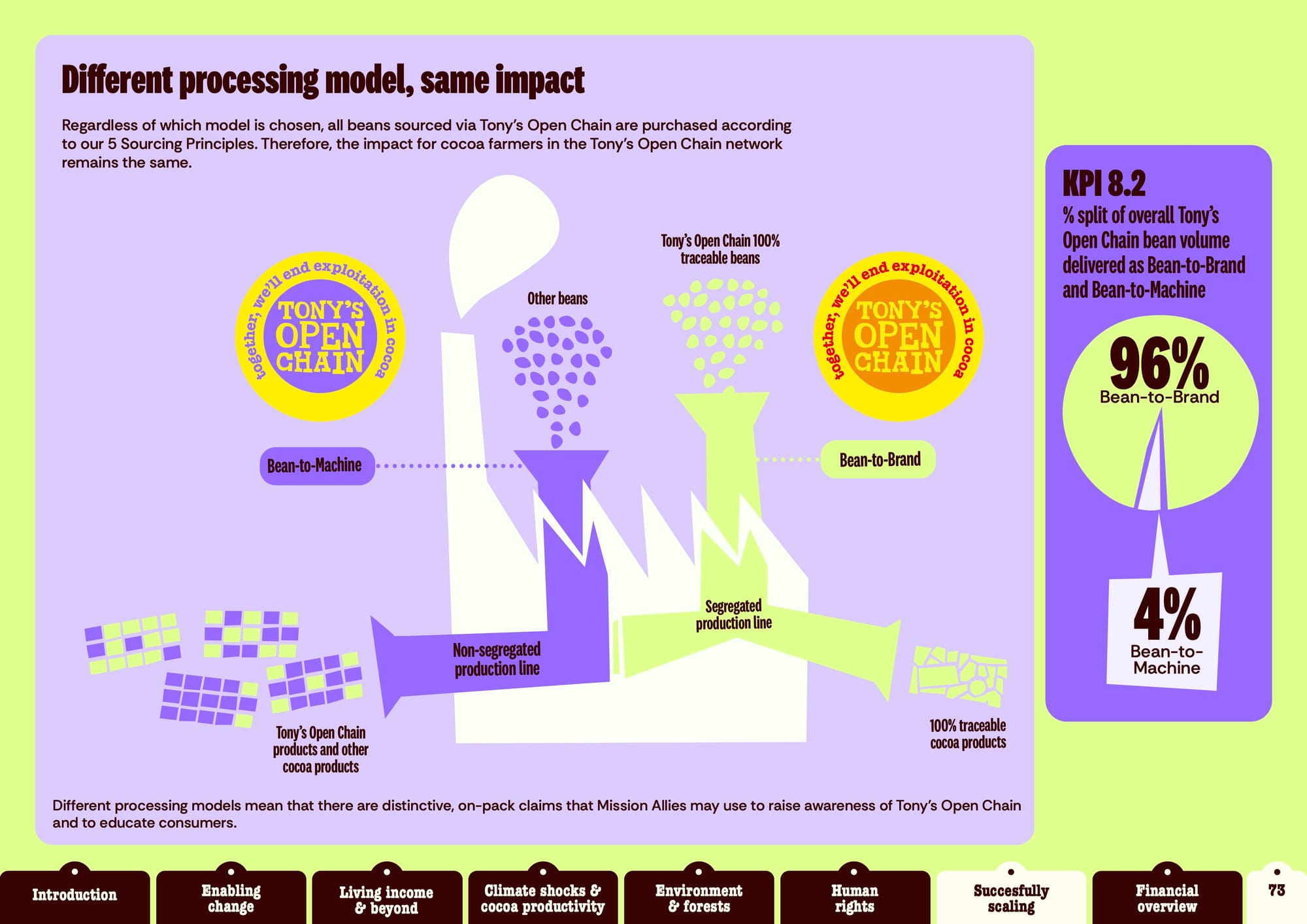

Tony’s Open Chain and mass balance

Tony’s Open Chain supports its partners practiing mass balance, which is, to many people (me among them), a slippery slope of greenwashing. Pages 204-205. Mass balance is explicitly supported by the Rainforest Alliance.

In practice, mass balance enables chocolate manufacturers to claim compliance with certification rules for products they manufacture if the total amount of product that bears the label does not exceed the amount of certified cocoa they purchased. A chocolate bar might contain 5% (or less) certified cocoa and still qualify to be labeled as certified under this scheme; the chocolate does not have to be made with 100% certified beans.

Mentioned in the episode\

Gemini’s “thinking:”

(1) From the `TOC_Impact_Report_2023-2024_V12.pdf`, identify and list all technologies, software, and digital systems used by Tony's Open Chain, such as BeanTracker, CLMRS, and GPS mapping tools.

(2) For each technology identified, describe its specific function and purpose in the cocoa supply chain, detailing how it contributes to traceability, monitoring, and farmer support.

(3) Analyze how the combination of these technologies supports Tony's 5 Sourcing Principles, particularly in ensuring traceability, preventing deforestation, and addressing child labor.

(4) Detail the role of partner cooperatives in the implementation and data ownership of these technologies, as explained in the report's 'cooperative-centric approach'.

(5) Identify any pilot programs or future technological initiatives mentioned in the report, such as the 'FarmSmarter' application or the expansion of digital payment systems.

(6) Synthesize the information to provide a comprehensive overview of how technology is leveraged to create a transparent, responsible, and ethical cocoa sourcing model.

AFR Index

| Fair Reports | online index | ||

|---|---|---|---|

| Year | Title | Pages | Note |

| 2012/2013 | better | 68 | |

| 2013/2014 | woow | 84 | |

| 2014/2015 | look at ’m shine | 116 | |

| 2015/2016 | what a blast | 108 | |

| 2016/2017 | on the way up | 116 | |

| 2017/2018 | good for the garden | 132 | |

| 2018/2019 | read it here | 108 | |

| 2019/2020 | out of this world | 172 | |

| 2020/2021 | fair and square | 212 | |

| 2021/2022 | so much impact | 205 | |

| 2022/2023 | another cho-tastic year | 52 | “highlight report” |

| 2023/2024 | raising the bar again | 219 |

| TOC Reports | online index | ||

|---|---|---|---|

| Year | Title | Pages | Note |

| 2021/2022 | Open Chain Impact Report | 28 | — |

| 2022/2023 | Open Chain Impact Report | 86 | — |

| 2023/2024 | Open Chain Impact Report | 86 | — |

Questions?

If you have questions or want to comment, you can do so during the episode or, if you are a ChocolateLife member, you can add them in the Comments below at any time.

Episode Hashtags and Socials

#cocoa #cacao #cacau

#chocolate #chocolat #craftchocolate

#PodSaveChoc #PSC

#LaVidaCocoa #TheChocolateLife

Future Episodes

Onde Cresce O Chocolate (Where Chocolate Grows) with Juliana Aquino (Baianí), Arcelia Gallardo (Mission), Claudia Gamba (Mestiço) et al.

#PodSaveChocolate and #TheChocolateLifeLIVE Archives

To read an archived post and find the links to watch archived episodes, click on one of the bookmark cards, below.

Audio-only podcasts

Become a Premium ChocolateLife Member!

| These offers are available to free members, so subscribe above then click one of the following links. | |

|---|---|

| Team TCL Member Monthly membership | First 2 months FREE (save $10/yr) |

| Team TCL Leader Monthly membership | First 2 months FREE (save $30/yr) |