Ghana & Côte d'Ivoire Throw Down a Gauntlet

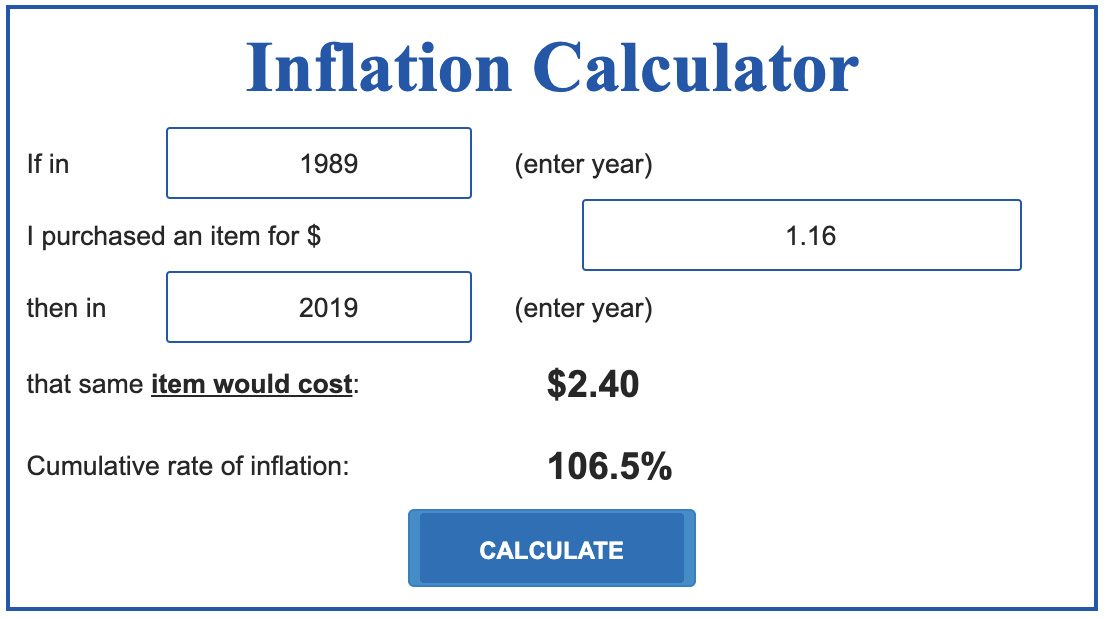

The price of cocoa is currently trading at almost exactly the same price it did in 1989, adjusted for inflation.

The average price of cocoa in 1989 was US$1.16/MT. In December that year it dipped below US$1.00! According to ICCO, the market price for cocoa on June 19, 2019 was US$2445, pretty much exactly in line with inflation.

This does not take into account actual cost increases across all aspects of the supply chain or in other areas of the economy. All it does is say, “In 2019 I would pay $2.40 for something that cost $1.16 in 1989 dollars.”

On June 14th, 2019 the governments of the Ivory Coast and Ghana said they will suspend sales starting 2020/21 for better prices – demanding a minimum of US$2600/MT. This is about a 6% increase over the current price.

By making this demand, the governments of the two largest cocoa-producing countries – who between them produce roughly two-thirds of the world’s cocoa – hope to address the imbalance between farmer income and the profits earned by the largest commodity traders.

The World Cocoa Farmers Organization (WCFO) called upon the governments of the two countries to reconsider their demand citing, among other concerns, that farmers were not involved in the decision-making process, that ICCO was not involved, and that the cocoa economies – and thus cocoa farmers – of other countries would be affected.

Following a two-day meeting, Joseph Boahen Aidoo, chief executive of the Ghana Cocoa Board, told a news conference that their demands had been accepted in principle by the participants (which included producers and traders), noting that, “Over the years it has been the buyers who have determined the price for the suppliers.”

In October 2018, the FLO Fairtrade (FT) price floor for conventional (not organic) cocoa increased by 20%, from $2,000 to $2,400/MT. The premium also increased by 20% from $200 to $240. (The new pricing structure is set to take effect Oct. 1, 2019.)

As I understand the way the FT pricing floor works, if the price dips below this level, buyers must pay the minimum for FT-certified cocoa. It’s not clear what this means for the FT pricing and premium scheme.

It’s important to note that while members of the cocoa industry in Ghana and Ivory Coast have agreed to this new price, how it will be implemented is still up for discussion – and there is no indication, yet, of how Big Chocolate (the ten big companies that control 85% of the market) will react.

Small, specialty, chocolate makers may think this will not have an impact on them, but it almost certainly will. A lot of cocoa is priced as a premium to market and who knows how the market will react to this demand and how prices will change.

What do you think? Will $2.60/kg become the new floor on the exchanges? Will the specter of a drastic reduction in supply push prices sky-high? Let us know in a comment below.

Sources

EuroNews (video)

AfricaNews

Cocoa Post (blog)

And this is where things appear to have settled out:

An interesting article about setting price floors on coffee and how that might backfire. The same basic challenges the author suggests are also present in cocoa.

And here:

And more, here:

Some commentary on this move (plus a lot of other coverage if you click through to the home page):